We Believe in Active Money Management

Here at Grand Capital Management, we believe that every investor should have an opportunity to participate in outstanding money management. This is why we operate as independent investment adviser representatives of First Advisors National (FANAdvisors). FANAdvisors has partnered up with professional money managers across the U.S. to provide our clients with access to Unified Managed Accounts (UMA). Through Unified Managed Accounts, clients have access to multiple money managers in a single account.

In addition to this unique investment feature, there is no minimum deposit required to open an account with us.

Tactical Investment

Strategy

Strategic Investment

Strategy

A tactical investment approach includes a continuous monitoring and adjusting of client asset allocations. With a tactical investment approach the portfolio manager can move between asset classes, and even move to a cash position to avoid major downturns. This can occur monthly, weekly, or daily depending on economic indicators, and trends.

A strategic investment strategy is the traditional approach to investing known as the “buy-and-hold” approach to investing. This strategy is designed to invest in a fixed allocation of assets, and stick to that portfolio mix during the majority of the clients investment horizon. This strategy takes the emotion out of investing during times of market uncertainty.

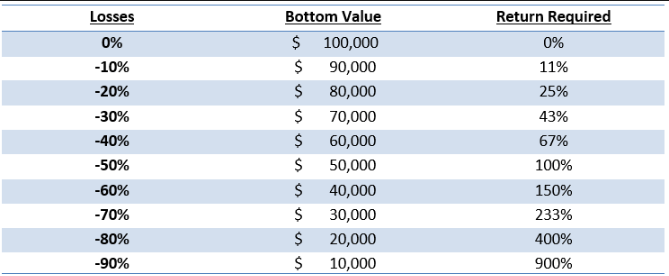

The important avoidance of loss

We understand our clients want the ability to make money, but they also want the protection from downside risk. This is the fundamental reason Grand Capital Management believes in actively managed money. Appreciation of our clients investments, and avoidance of losses is our main priority. This combination, when done properly can produce outstanding investment results and increase our clients potential to reach their goals.