You Wont Regret Independence

Go Independent & Change Your Life

Who Am I & What's My Story?

My name is Carl Grande, & I’m just like you… A practicing financial planner. My CRD is #6876875 (I’m sharing this with you so you know I’m not blowing smoke 😉).

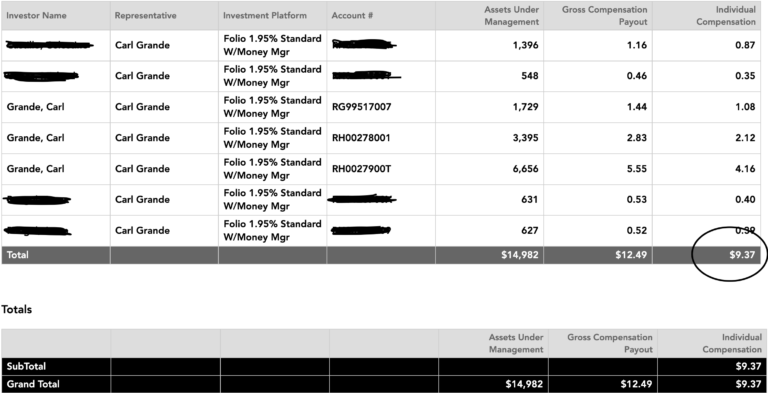

I started the investment advisory business with $0 in assets in November of 2017… When I mean $0, I mean $0… My first check was $9.37 and it was mostly my own money I was managing! See above 👆🏽

I started at $0 because the company I had been representing had a 2 year Non-Compete… So, when I left… I couldn’t really go and get all my clients! I know they say that “non-competes don’t hold up in court”, but they had much deeper pockets than me so I felt like I couldn’t rock the apple cart… That’s why I started this business with $0 in AUM.

Now, 5 1/2 years later… I make $100,000+ in annual residual income… As of Q2 2023, I’m managing $14,000,000 in AUM & another $2,000,000 in annuity business. I consistently do $40,000- $50,000 in Life/DI/LTC premium every year; All through Financial Planning… I also charge clients One-Time financial planning fees of $2,500 and bring on 20 new clients a year (at a minimum). YTD Revenue in my practice is $111,072 as of 07/28/2023…

There is a TON of revenue opportunity per client when you’re independent…. Usually between $5,000- $40,000 per client case (depending on your market).

None of this may seem impressive (and it’s not) but it’s REAL… & for the right person (you), who’s considering leaving their big firm… I’d rather give you the truth than inflate some unrealistic fantasy that keeps you from really moving the needle…

I got in this business for 3 reasons: Unlimited income opportunity, to help people with their finances, & to provide for my family… I’m betting that’s why you got into the financial service business too. Except as time has gone by, the industry you loved has been reduced down to repetitive sales pitches, mundane tasks, or being on an island by yourself… Or maybe what you’re doing is no where near what you thought your career would turn into…You might be thinking. “There’s got to be a better situation… Higher comp… More autonomy… Better technology… Lower fees… & less overall Bull$#%^”

There is a better a place… It’s just not where you’re at (more about that later).

When I first got started I spent 5 years at an Insurance Broker/Dealer (Allstate Financial) selling life insurance and indexed annuities… I did pretty good too… Top 15 in the state in one year!

Every January 1st though… I started at $0… New production requirements were given to me… A new carrot to chase, and no momentum from the previous years efforts… Sure, there was small life or annuity residual… but who really takes the trail comp on annuities!? Plus… at NY Life, Prudential, Allstate, Northwestern, or AXA.. You’re typically only getting 60% of 5%… (which is really only 3%!) That’s IF you’re on the highest tier of comp…

You see this garbage? I knew there was better out there… Especially, if I was finding my own clients.

Independents get paid 5-7% on annuities. ON ALL OF IT. So, a 10-year $1,000,000 annuity for a 65 year old will pay you $60,000 on average… Not $30,000!😳

Independents get 100% on life insurance premium. Yup, a $4,000 term premium pays you $4,000 first year! Disclosure: slight reduction for policy fee & comp percentage varies by carrier & term, but it’s right there…

Independents have 0, none, nada in production requirements! Your comp stays at 100% even if you don’t “hit numbers”.

Independents keep 100% of their financial planning fee… If you charge a client $2,500… You get $2,500 🙂

Independents can get 1% of AUM… Yup, you guessed it… If you have $10,000,000 in client assets managed you get $100,000 in income (assuming no breakpoints)… If you have $25,000,000 you would make $250,000. Disclosure: if you have $0 in AUM you start at .80% & work up to 1%

Independents have WAY BETTER TECHNOLOGY and are fast & nimble to keep up with market trends

Independents (not all) have NO NON-COMPETES to deal with… So, if you come over here and try your hand at independence and don’t like it… You can walk with your clients or your team

Independents have no FINRA crap… No broker/dealer licenses = no broker/dealer fees and compliance 😉

Advisors mistakenly think that it’s the big company thats been around for 100 blah blah years, that has X number of policyholders at the mutual blah blah is what gets you the deal… It’s not… It’s YOU… It always has been & always will be. I know this to be true because I spent 5 years at the big company telling that story and 5 years independently telling my story… Which do you think is more effective!?

The grass is greener… You deserve more & I want share it with you!

Approach

Our approach with you is customized to you… This is your practice/business we’re talking about. So, if you communicate to us what you want in your practice, we will share our resources and partners to see if there is a good fit. Independence is not for everyone, so if we can provide you value… We’ll keep the conversation going.

Approach

Our approach with you is customized to you… This is your practice/business we’re talking about. So, if you communicate to us what you want in your practice, we will share our resources and partners to see if there is a good fit. Independence is not for everyone, so if we can provide you value… We’ll keep the conversation going.

Your Vision

- How do you want to serve clients?

- Do you want a lifestyle practice or a big organization?

- What do you need in business to be joyful & feel aligned?

Vision

- How do you want to serve clients?

- Do you want a lifestyle practice or a big organization?

- What do you need in business to feel joyful & aligned?

The 10-Steps to Success

Step 1: Dialogue and Discovery

Step 2: Define your dream practice/business

Step 3: Discover our partners & technology

Step 4: Use our tools and practice

Step 5: Licensing, Registration & Contracting

Step 6: Niche Practice Discovery

Step 7: Niche Practice Marketing Techniques

Step 8: Business Development Strategy

Step 9: Business Development Execution

Step 10: Live the blessing of Life

Our Steps

Step 1: Dialogue and Discovery

Step 2: Define your dream practice/business

Step 3: Discover our partners & technology

Step 4: Use our tools and practice

Step 5: Licensing, Registration & Contracting

Step 6: Niche Practice Discovery

Step 7: Niche Practice Marketing Techniques

Step 8: Business Development Strategy

Step 9: Business Development Execution

Step 10: Live the blessing of Life