The question we’re going to address here pertains to an internal thought about the value of the profession and where it currently stands in the lives of clients. The financial planning business has evolved substantially since the days of securities brokers and financial insurance agents pitching product.

When looking at the business from the adviser perspective, there is a ton to be proud of: The standard of care has increased, the planning is more comprehensive, the service is excellent, clients are far more educated, and technology has made it very easy to provide a comprehensive service business to the general public.

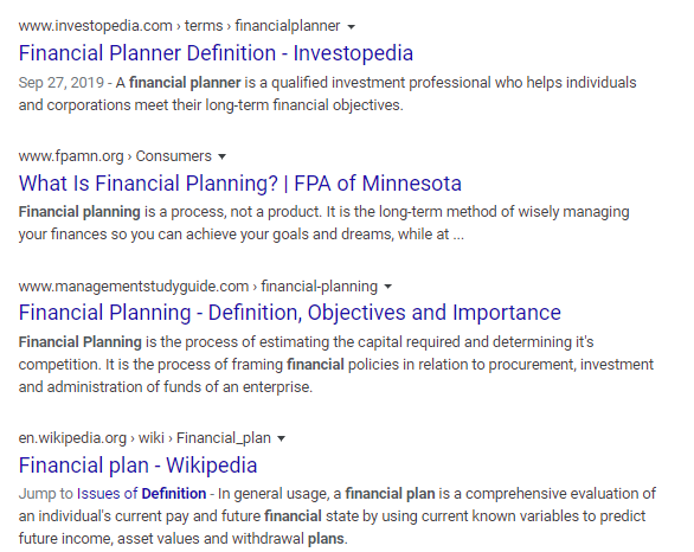

For the consumer though, it has not been such a pleasant experience. In fact, it has been a nightmare understanding what a financial planner does and who to trust. Some of the questions and comments we hear are, “What’s a fiduciary?” or “What company do you work for?” and my personal favorite, “My cousin just started doing financial planning part-time!” Although some of these are perfectly reasonable, it suggests the lack of understanding about the business and what to look for. When an individual google searches, “Financial Planning” these are the results.

Not so convenient for the client, is it? Especially in a world where everything is right at our fingertips.

Without proper financial education from parents or experienced resources on which way to go, the hard-working American is left siphoning through ads or trusting a referral from a friend. We want to help clear the air as to what someone should be looking for when searching for an adviser.

Here are a few pointers:

- A Financial Adviser Works Full-Time– The vast amount of knowledge and technical understanding of financial products and strategies cannot be obtained by working part-time after the bowling alley gig. If you do come across someone who is learning the business part-time, please make sure there is an experienced team supporting them.

- Higher Education and/or Experience– The average age of a financial adviser is over 57 years old. This is not always the best option because not every adviser keeps up with technology and changing regulation. Clients should look for an adviser with at least 5 years of industry experience and/or a career designation like the CFP (Certified Financial Planner). The CFP board requires advisers to have 6,000 hours of industry experience and a bachelors degree before they can use the mark. If you come across someone who is in the process of obtaining the mark, you are probably safe to work with that individual.

- A Financial Adviser Provides Comprehensive Work– When working with clients on investment contributions, advisers need to consider a budget. When working with clients on a budget, advisers need to consider income. When working with clients on income, advisers need to consider insurance. When working with clients on insurance, advisers need to consider lifestyle. A financial adviser considers everything in your financial life relevant to the advice. If it’s not comprehensive like this, it’s not legit.

- Fiduciary– This term is an important one. This means that the adviser is held legally responsible for the advice they give to clients. Fiduciary advisors are important for clients because they are legally required to put clients’ interests ahead of their own. They have a duty to best execute, be loyal, disclose conflicts of interests, and many others. A Fiduciary adviser represents the client, not the company.

- Conflicts of interest– When a client is in search of the right financial planner to work with, it is important to find out what kind of conflicts exists when providing advice. Ideally, you want to work with an adviser that is not burdened by management to “produce numbers”. At that point, the relationship dissolves to a numbers game. A good adviser will position themselves to reduce conflicts of interest as much as possible. An example of this is when a proprietary investment model is created by the firm. There is an incentive to encourage clients to invest within the methodology of the firm rather than outsourcing investment management to a portfolio manager that might fit better with a clients’ risk tolerance.

Overall, we take the position that most advisers are in the business to help people and create wealth for their clients. We also encourage clients to speak with financial advisers and develop relationships with people and understand how they can further their financial position. The pointers mentioned above should be utilized when searching out the right planner to work with. Good Luck!